Archie Bunker was a bigot. He was a loud-mouthed, closed-minded, assertively prejudiced, blue collar bigot who dreamed of a time when people who thought like him would be in charge of the country. And Archie Bunker would have hated what is going on right now, but probably not for the reasons you’re thinking.

George Jefferson was Archie Bunker’s equal in many ways (some might even argue his superior). While no one could call them “friends”, per se, they certainly served as perfect foils for each other: two lovable, obstinate characters, each one proving that stereotypes never holds true when confronted with individual identity. “All in the Family” meets “Moving On Up”. And these shows left lasting memories. And they always showed prejudice and bigotry as the idiocy that it is; both characters always got what they deserved.

Do these sitcoms hold up? Are they worth watching nearly (gasp) 35 to 45 years later? A recreation in 2019 on TV would argue yes (as would Kerry Washington, Jimmy Fallon, Jamie Foxx, Wanda Sykes, Woody Harrelson, among others). These shows were way ahead of their time, or — sadder to say — our times haven’t moved way ahead in the last 40 years, and nothing is more relevant today than confronting the scourge of racism and the terrible conditions faced by BIPOC (Black, Indigenous and People of Color) in our country. We all should dream of a day when shows like “The Jeffersons” and “All in the Family” are viewed as relics of a historical past, barely able to be conceived of, and not simply dated reflections of our present.

With that in mind, “all in the family” carries a different connotation for me for financial aid, and I want to turn there next.

But first, a check in. How are you doing, dear reader? I personally have not been OK. The trauma of the last few weeks has me sad, angry, anxious, depressed, and frankly traumatized. And I am a white, cis-gendered, married man in my 50s who never has been the victim of systemic racism. I know that I am privileged and am here to witness, to listen, to learn, and to act to make change. This is not a political statement, this is a human statement. And I am here to partner with each of you to make change possible.

For me, that means I do all that I can to demystify the financial aid process so that each one of you can find your way into economic opportunity through higher education (and find the best and most cost-effective way to pay for it). We talk about a lot of subjects here, but the most important one is you. I am hoping you are OK. If not, I am here to listen. Contact me by commenting below or using the comment form.

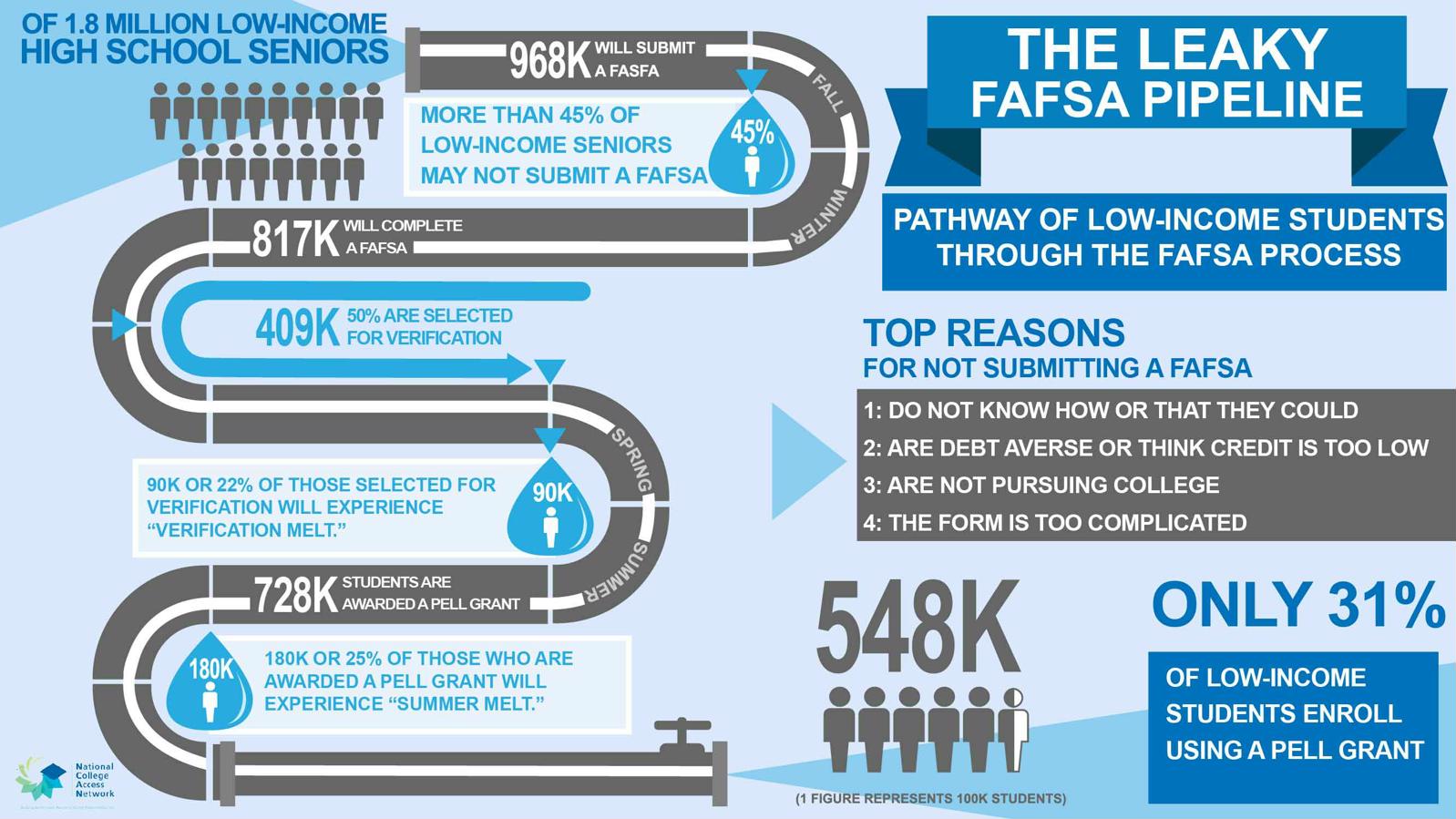

Now to our financial aid subject: “All in the family”. Part of the verification process requires you to document who is in your family. And who will be in college. If you remember back to when you completed the FAFSA, you entered these numbers on the form. If you have been selected for verification, now is the time to provide your list.

Schools will ask you to complete a list of those in your family on the verification form. You will list each person, their relationship to you (the student), their age, and (if they are in college) where they are attending school. For a dependent student, this will mean the members of your parent(s)’ household. You usually will list the parent or parents you live with, if you have step-parents living with you, your siblings or step-siblings who live at the home with you, siblings or step-siblings at college or living elsewhere if your parent(s) provide more than 1/2 of their support, and any other person for whom your custodial parent provides more than 1/2 of their support if they live with you. This might include your grandparents, for example, if they live with you, or your cousin, or aunt, or uncle (if your parents provide more than 1/2 of their financial support each year).

A common mistake people make is assuming that someone has to be listed on your parents’ tax return as a dependent in order for them to be part of your family. This couldn’t be further from the truth; there does not have to be a one-to-one relationship between them. You do want to be prepared, though, to list them on your verification form because if the financial aid officer sees a difference between the number of people in your family on the FAFSA and the number on your verification form, they will want an explanation.

For an independent student, the household size always includes you and (if married) a spouse who is living with you. You can also include your children (even if they don’t live with you) as long as they receive more than 1/2 of their support from you (and your spouse). Finally, you can also claim people who live with you who are not your children if you provide more than 1/2 of their financial support (say an elderly parent or grandparent, or a cousin, or niece / nephew). Remember to list each of these household members on your verification form.

Now we turn to the number in college. If someone in your household plans to attend post-secondary school (college or university) at least half-time, even for one semester, they count as part of your family in college, with one big exception. For dependent students, you cannot count a parent in college. The government assumes (incorrectly in many cases), that parents in college have financial support for their education and are not paying that cost. (This, by the way, is a great example for when you might want to ask for a professional judgment; provide a copy of your parents’ tuition bill for their own education and ask the financial aid office to consider this as a cost when analyzing your EFC). The number in college also does not include students attending a service academy because most of their costs are paid for by the Federal government.

Otherwise anyone who counts as a member of your family could count as part of the number in college. The number in college is important since your PC (Parent Contribution) is divided by this number. For example, if a family has a 12,000 total PC, and two in college, each student would have a 6,000 PC (granting them an additional 6,000 in need each). If there were three in college, the PC for each would be 4,000 and all three students would likely be Pell Grant eligible.

On the verification form, you will be asked to list each college / university attended for each member of the family, and occasionally a school may ask you to have your sibling’s college fill out a form documenting that they really are attending there. Just another way to “trust but verify“.

In closing, while you want to think expansively and include everyone you can in your family list on the verification, you want to make sure you can document the folks you choose. In short, you want to make sure you keep it “all in the family”.

Here’s hoping and praying for change to come soon. In the words of James Taylor (in his song Shed a Little Light):

There is a feeling like the clenching of the fist

There is a hunger in the center of the chest

There is a passage through the darkness and the mist

Though the body sleeps the heart will never restOh let us turn our thoughts today to Martin Luther King

And recognize that there are ties between us

All men and women, living on the earth

Ties of hope and love, sister and brotherhood

That we are bound together

With a desire to see the world become

A place in which our children can grow free and strong

We are bound together by the task that ties before us

And the road that lies ahead, we are bound and we are bound